In a nutshell, you will pay income tax in Australia on any money you earn in Australia. Simple.

Buuuut it can certainly become more complicated if you earn money in another country, pay tax in another country, reside in another country, own property or other assets, have health insurance, live with a partner and children, have blue hair… not really but you get the picture. It gets complicated.

So in an attempt to make things slightly less confusing for you, here is my (extremely average) attempt to provide a basic overview of the things you need to understand about the Australian Tax System in lay terms. Here we go.

Your Tax File Number (TFN)

I mentioned applying for your TFN in my post on the checklist of things to do when you arrive in Australia. I’m not sure how long it actually takes to process (no more than a few weeks I’m sure), but you’re certainly able to start work before this comes through. If it takes longer than a month however, you will be taxed at the maximum rate – which I will explain later. The earlier you can get this sorted the better off you’ll be.

Once you do have your individual TFN, it’s yours for life. Keep it safe and only give it out to the ATO, your employer, your bank, your superfund and your tax accountant (more on that later). You don’t want any fraudulent activity happening in your name!

Pay As You Go (PAYG)

Taxes in Australia are collected under the PAYG system, which quite literally means that you pay tax as you go (similar to PAYE in the UK). When your employer calculates your wages each pay period, they will work out how much tax you need to pay on that income and automatically pay that to the ATO on your behalf, before paying you the remainder.

PAYG is great in that you don’t need to do any calculations yourself. Each week or fortnight or month you are paid, you automatically pay what you owe the ATO.

However, inevitably at some times in the year you will earn more and in others you will earn less, meaning that by the end of the financial year you may have paid too much or too little tax. This is why it is important to lodge a tax return.

Lodging a Tax Return

Lodging a tax return to the ATO is all about declaring how much you’ve earned, working out how much tax you paid over the course of the financial year, and calculating how much tax you should have paid.

The financial year in Australia runs from 1st of July to 30th June. If you’ve earned money in Australia in this period you’ll probably need to lodge a tax return, which should be done before 31st October.

After the 30th of June each year it’s time to get all your important financial documents together (payslips, receipts for tax deductions you might want to claim, bank statements etc.) so you can use them either to complete your tax return yourself online via myTax or give them to a registered tax agent to lodge on your behalf.

If you picked up on some of the not so subtle hints I was dropping earlier, taxes can get very complicated in certain circumstances, and there may be a lot of things you don’t understand or don’t even know about! So if this is your first time lodging in Australia it’s a good idea to use a tax agent to do your tax return for you – they can be relatively cheap, save you lots of money, and best yet their fees are tax deductible in the following financial year!

If your Tax Self Assessment determines that you have paid too much tax and are owed a refund then this can be deposited directly into your bank account. If you didn’t pay enough tax then the ATO will give you options to pay them directly by electronic funds transfer, or set up a payment plan so it’s deducted from your future wages.

How much Tax do I pay?

Ok, this will really help illustrate how confusing taxes can get because it’s depends on so many factors.

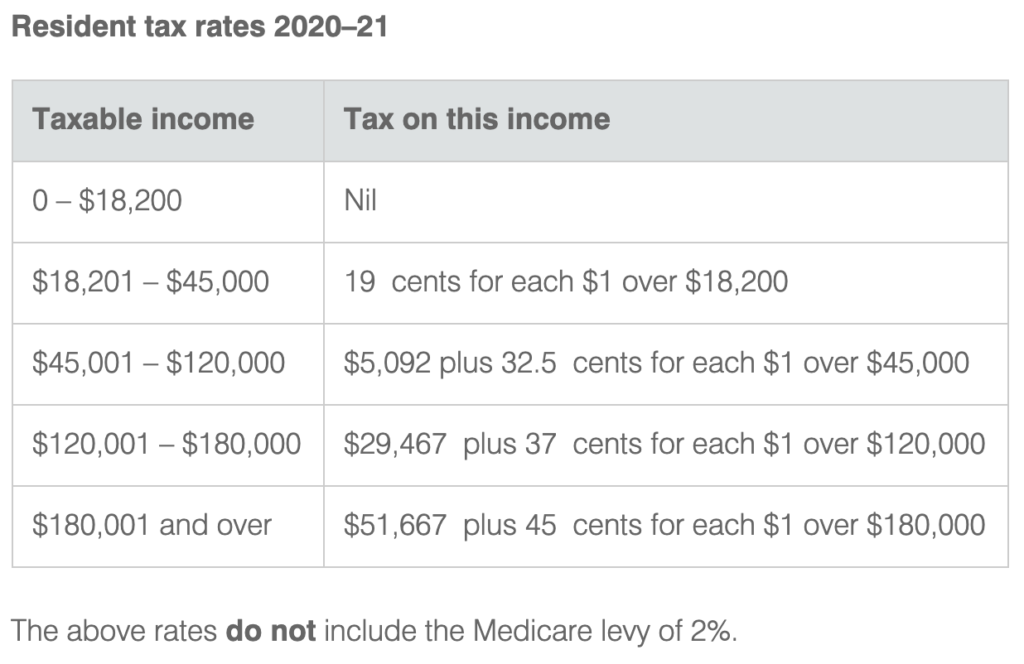

Australian residents will pay: