The UK Tax System Explained

Dealing with taxes at home is difficult enough, never mind trying to navigate your way through the tax system of another country. So I’ve done a bit of digging to try and nut this all out.

Dealing with taxes at home is difficult enough, never mind trying to navigate your way through the tax system of another country. So I’ve done a bit of digging to try and nut this all out.

Take note: I am in no way shape or form qualified to provide financial advice, and if my research has taught me anything it’s that international tax law is a very complicated business with lots of grey areas. Everyone’s circumstances are different, so if you’re not sure about something be sure to check the gov.uk website or seek professional financial advice.

Let’s get started with the very basics…

Her Majesty’s Revenue and Customs (HMRC) is the UK’s tax office and they collect two main taxes from you over here:

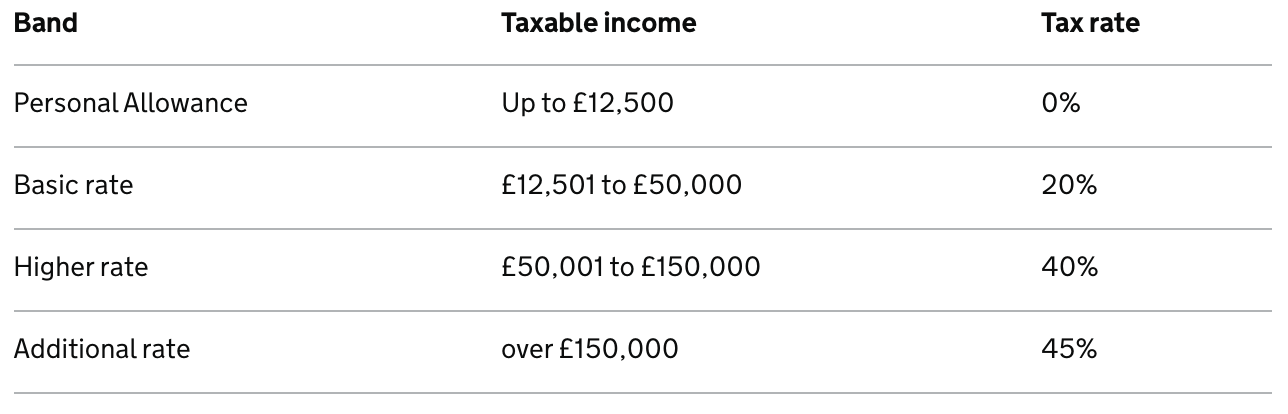

There are different income tax rates according to how much you earn each financial year, which in the UK runs from approximately the 6th April to the 5th April the following year.

There is a tax free personal allowance of £12,500, so you won’t pay tax on income up to this amount:

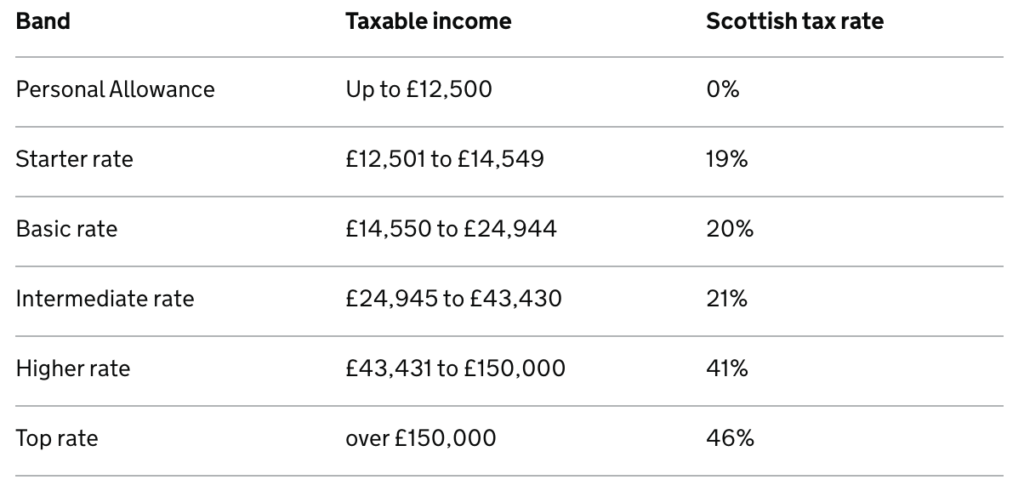

If you live in Scotland the rates are slightly different:

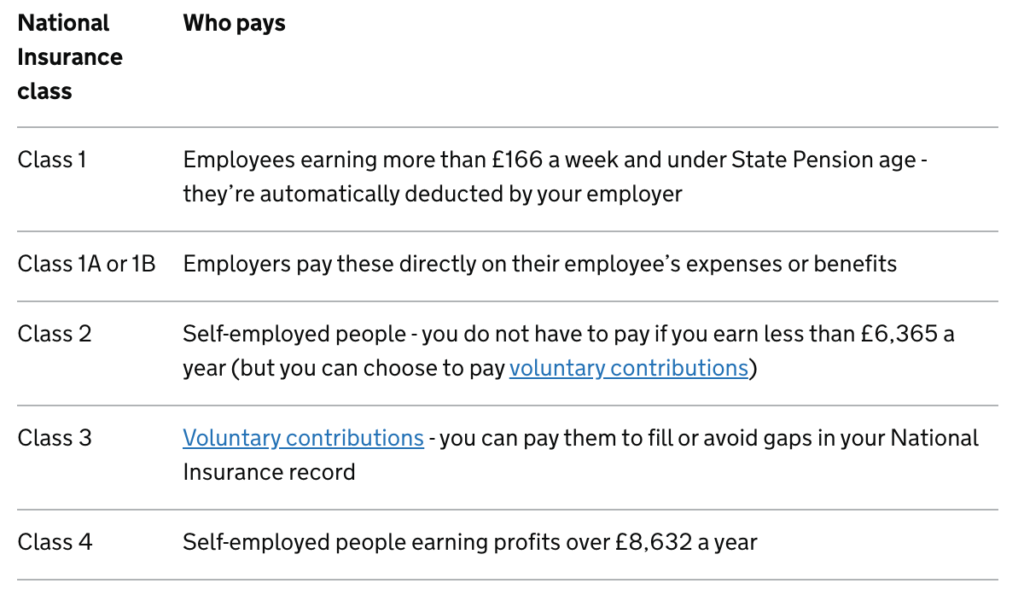

National Insurance (NI) is an additional tax that contributes towards Government social welfare payments including the state pension, job seekers allowance, maternity allowance and bereavement support.

The National Insurance Number (NIN) you applied for on entering the UK ensures that your NI payments are recorded against your name (see my article about applying for your NIN here).

This depends on your employment status and how much you earn:

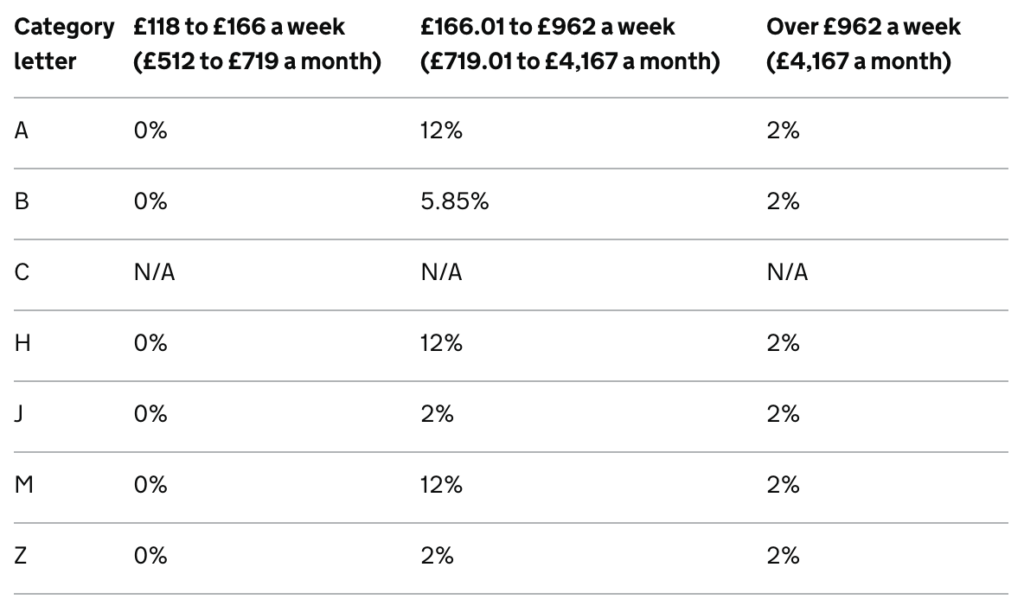

As a locum employed through an umbrella company you will more than likely fall into Class 1, Category A, in which case the amount deducted from your pay is:

Your income tax and NI will be automatically deducted from your weekly pay by your employer. On your payslip you should find deductions for:

You will also find it on the following forms:

Keep these somewhere safe for your tax records, the HMRC asks you to hold on to them for 22 months after the tax year.

Tricky. It depends.

And there are all sorts of financial implications for being resident or non-resident in the UK.

The HMRC have lots of criteria to determine your residency status including how many days of the tax year you spent in the UK (e.g. more than 183 days), your family ties and assets in the UK, and how much you work in the UK.

This will only really be relevant if you have to complete UK tax return – luckily the majority of people don’t have to, as you’ll see below.

Most people don’t complete a tax return each year thanks to the efficiency of the PAYE system – the HMRC calculates how much tax you should have paid each year, and if you’ve overpaid tax they’ll automatically provide a refund (and if you’ve under paid they’ll send you a bill of course). So unless you are a UK resident for tax purposes, have a lot of income or assets outside the UK, or have a lot of expenses to claim it’s unlikely you’ll need to file a return.

To spell this out for you:

I’m an Aussie, and both Australia and the UK tax their residents on their world-wide income – does that mean I have to pay tax in both countries?

In a word, no. The Double Taxation Agreement (DTA) between Australia and the UK is designed to ensure you don’t pay tax twice on the same income.

Again, the in’s and out’s of this will differ depending on your individual circumstances (residency, property, assets etc.). As it’s a bit complicated, best to seek some professional advice from someone specialising in expat tax affairs to find out where you should be paying your taxes.

Essentially you will notify the Australian Tax Office (ATO) of your world-wide income on your tax return, and some sort of foreign tax offset thingy is applied…

Sorry if you’re reading this and not an Aussie! You can always check if your own country has a DTA with the UK.

Basically you don’t get to run away from it any more. Changes made by the ATO a few years ago mean that you still have to make repayments to your student loan while you’re overseas, even if you’re not an Australian resident for tax purposes.

You need to notify the ATO either through your myGov account or Australian tax agent that you are moving to the UK. The amount you repay on your debt will be calculated based on your world-wide income each financial year, and your Australian residency status.

For all the confusing details, check out the ATO website.

Claiming “tax-relief” is fairly strict in the UK, so you might not be able to make a claim for absolutely everything you could back home.

If you complete a UK tax return you may be able to claim tax-relief for work or business expenses that you paid for ”wholly, exclusively and necessarily” for work. So this could include HCPC rego fees, laundry costs, and uniforms, but not clothes or shoes that you wear outside of work as well.

If you don’t usually complete a tax return you can use a P87 form to claim business expenses you’ve paid for that total less than £2,500 in the tax year – you must have paid tax in the financial year to make a claim though. You can complete this form for up to 4 previous financial years.

As always, best to chat to your accountant before getting caught up in this stuff!

If after reading my very basic summary of the UK tax system you’re still not sure about something (which is entirely possible given my lack of expertise in this area) try the following people: